Our prices

Price list for single API calls

- Bank of Italy Business Visura € 17,50 + vat

- Experian Company Visura € 17,50 + vat

Check a company's credit standing with the Bank of Italy and Experian

With Openapi you can request the Central Risks Report and Experian Report by company via API

Risk Reports allow access to the information system that monitors the indebtedness that legal persons have towards banks and financial companies. It is possible to access and check the status of a subject in the main Risk Centres of the Bank of Italy and Experian.

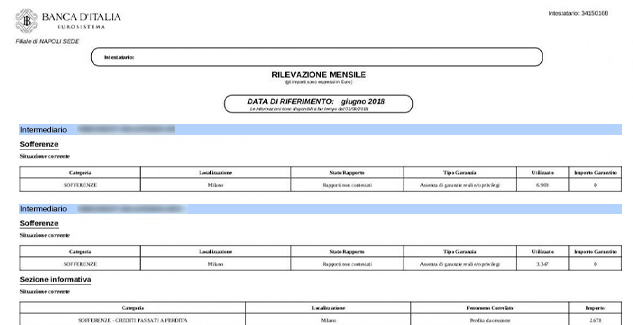

The Bank of Italy Central Risks Report allows individuals to have access to data from the Bank of Italy's Central Risks Database. The Bank of Italy Report allows you to check negative reports with outstanding debts relating to current credit facilities, loans, credit cards, loans, and credit facilities, simply by requesting a Central Risks Visura.

The Experian report allows users to access data managed by SIC, the Credit Information System, and check their position, credit score and creditworthiness. The document highlights current or extinguished loans, financing, bank mortgages and any negative reports for non-payment or late payment as well as positive ones.

PLEASE NOTE: Access to data from the Central Risks Office of the Bank of Italy and the SIC, Credit Information System, is only allowed to holders of the report, legal representative in the case of a company or legal entity. It is essential to send a copy of the identity card of the person for whom the certificate is requested. In the case of legal entities (non-commercial entities, associations, foundations, companies, partnerships or corporations, consortia, etc), a copy of the identity card of the legal representative of the legal entity for which the report is being requested must be sent.